IRS Tax Professional Account

Description

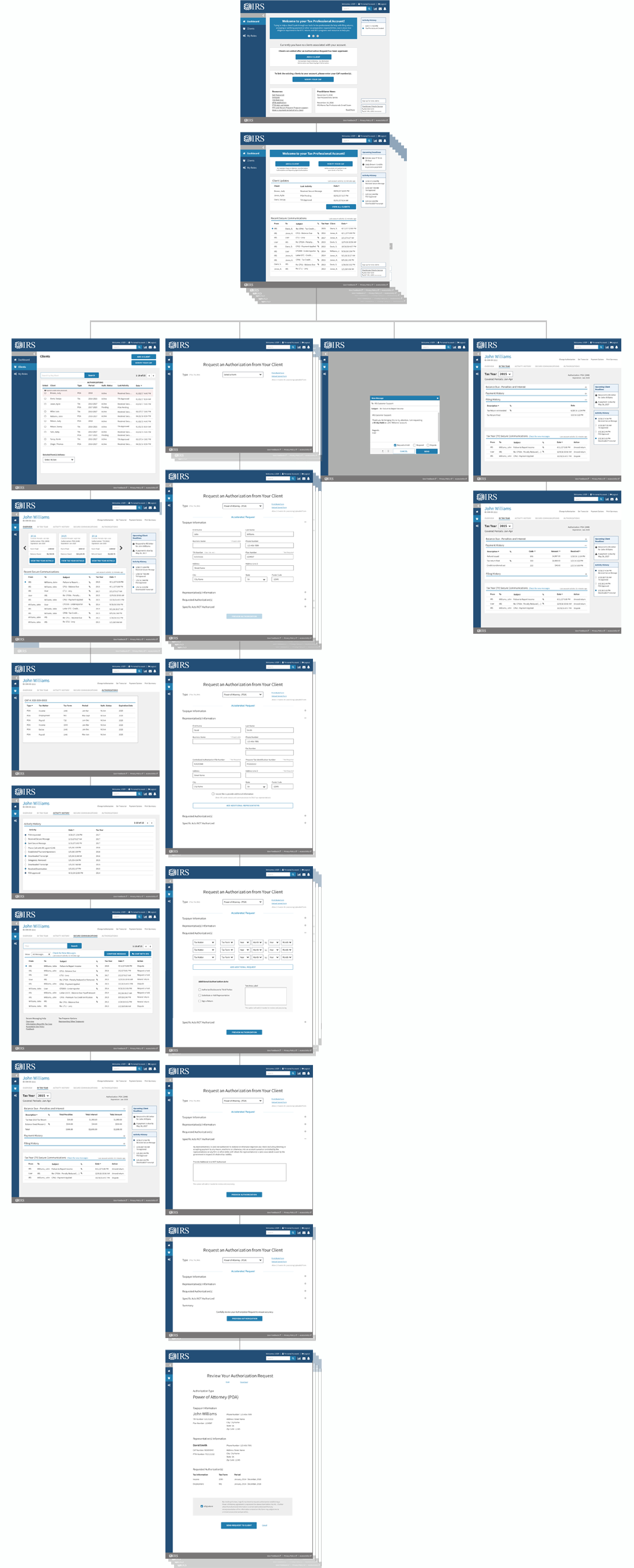

Develop a functional prototype informed by insights derived from user testing efforts with tax professionals that uncovers their needs and expectations in regard to managing their clients’ tax relationship and obligations with the IRS. Conceptual models explored solutions focused on improving capabilities and functions specific to managing client authorizations, tax records, and obligations.

Challenge / Goal

Uncover tax professionals' pain points emerging from IRS processes resulting in high call volume, inefficient authorization management, and timely access to clients’ tax information in order to design, test, and build the optimal solution to showcase during the annual tax forums in order to gain industry affirmation and seek funding for the MVP.

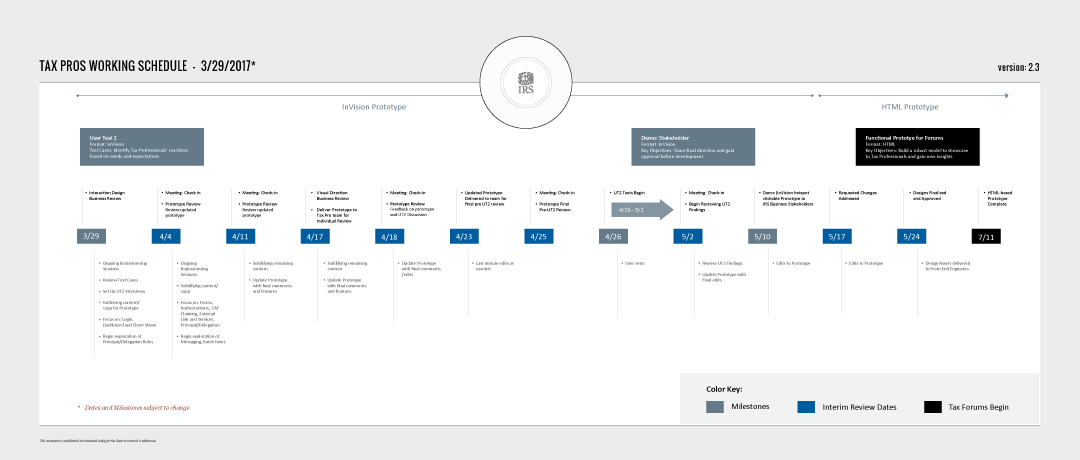

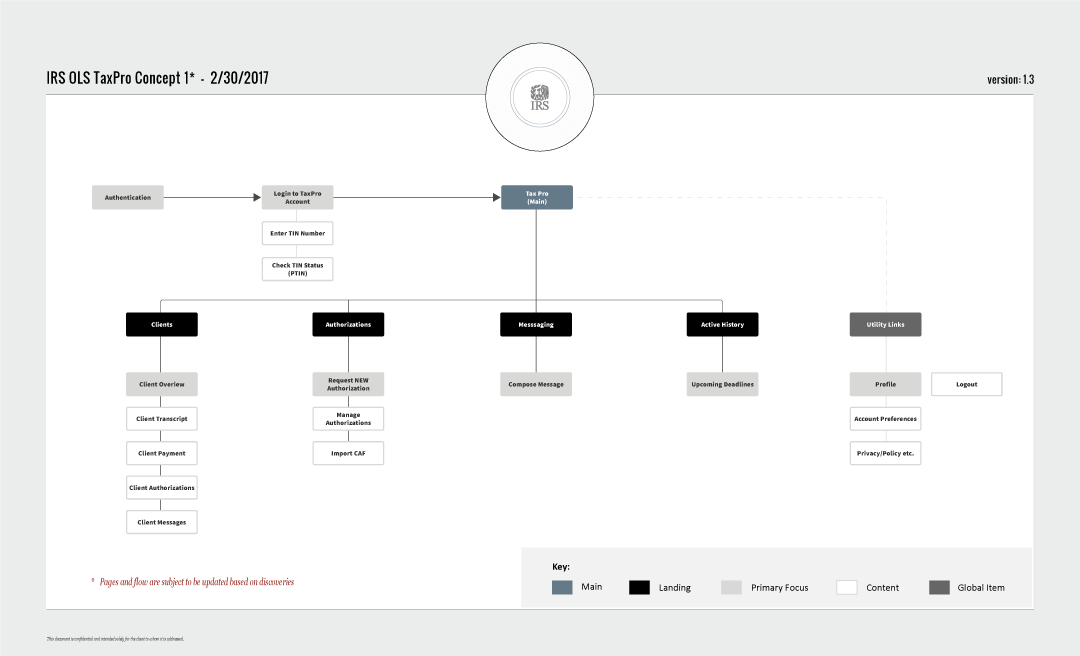

Discover

Conducted scoping exercises and defined key objectives to construct high-level roadmap(s) that highlight milestones and deliverables for each of the two major phases that included user testing efforts.

Role:DESIGN LEAD, UI / UX DESIGNERResponsibility:TEAM LEAD | CREATIVE AND STRATEGIC DIRECTION

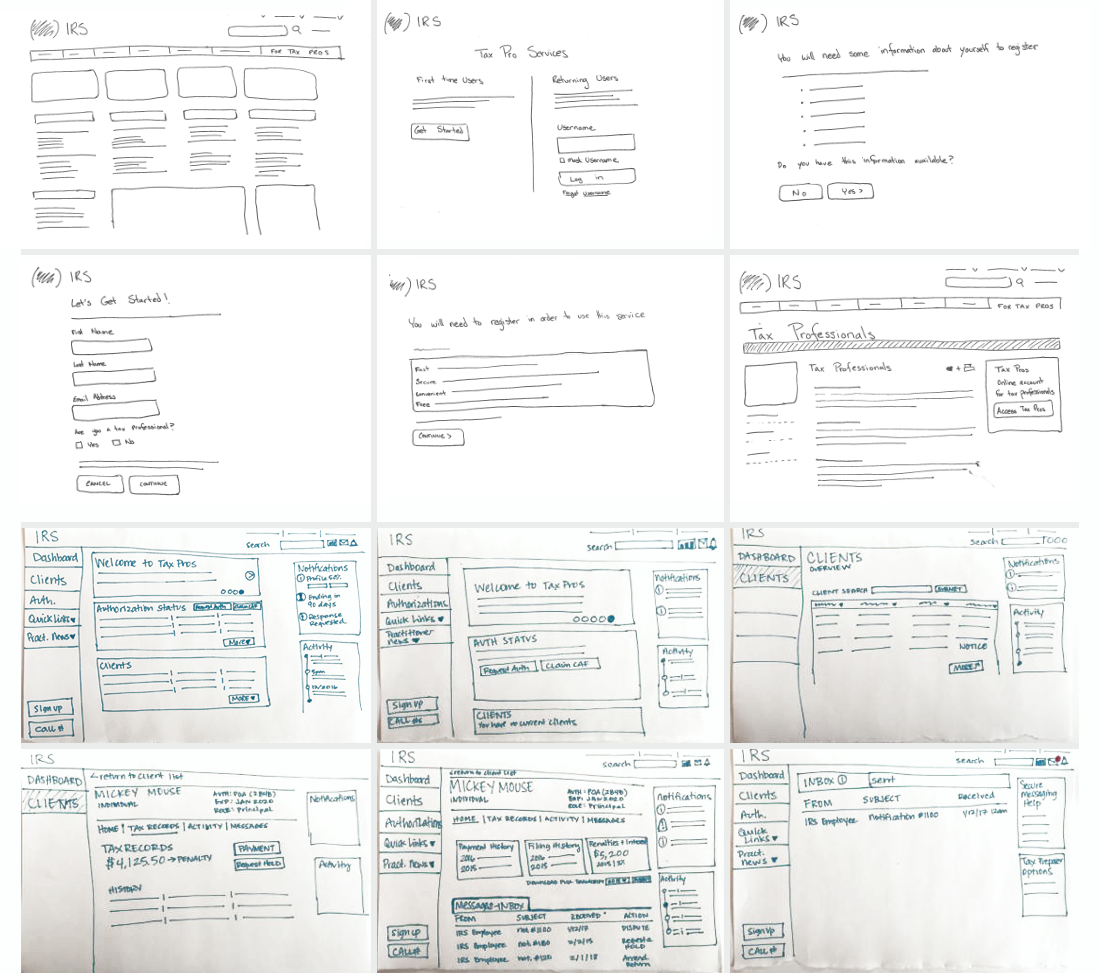

Explore

Applied Human Centered Design (HCD) and Lean principles throughout each stage (whiteboard exercises, paper sketches, low- and high-fidelity mock-ups) to review, analyze, and inform the optimal experience.

Role:DESIGN LEAD, UI / UX DESIGNERResponsibility:TEAM LEAD | CREATIVE AND STRATEGIC DIRECTION

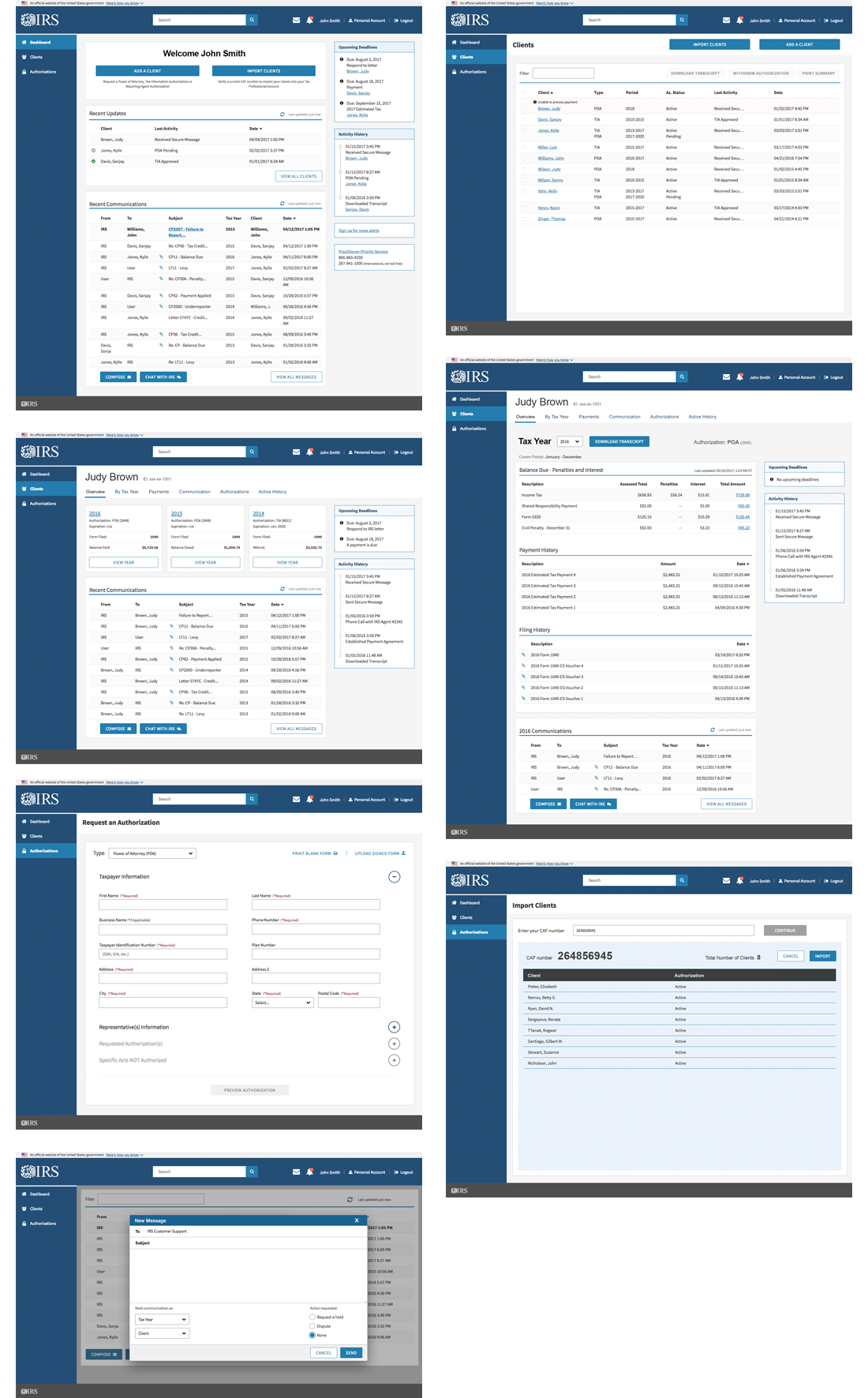

Establish

After months of iterations and two rounds of user tesitng the team obtained stakeholder approval to showcase the prototype to tax professionals at the 2017 Tax Forums.

Role:DESIGN LEAD, UI / UX DESIGNERResponsibility:TEAM LEAD | CREATIVE AND STRATEGIC DIRECTION

Measure

With high-quality UX insights obtained from two-rounds of user testing sessions, and wide praise received from tax professionals at the industry Tax Forums the team set focus to define scoping and seek funding and prioritization for the MVP.

Role:LEADERSHIPResponsibility:TEAM LEAD | CREATIVE AND STRATEGIC DIRECTION